A Review Of Do I Have To List All My Assets and Debts When Filing Bankruptcy?

Can it be advisable? Definitely not! If you receive caught in that lie then your bankruptcy circumstance may get dismissed with prejudice so you are actually caught with all that debt. Additionally, if the US Lawyer’s Workplace has some spare time on their arms, You might also be prosecuted for bankruptcy fraud.

To put it differently, leaving your charge card out of your respective bankruptcy won’t permit you to retain the cardboard. Genuine, a card which has a zero equilibrium isn’t technically a personal debt, which means you gained’t encounter any penalties for leaving out a zero-balance card. Although the lender will nevertheless shut the account.

But there is a security valve within the Bankruptcy Code to the truthful Chapter seven bankruptcy debtor who innocently omits a creditor’s name and tackle through the bankruptcy petition paperwork submitted Together with the court.

Leaving a debt out within your circumstance triggers your income and cost calculations to become inaccurate, which makes it surface that you simply have way more disposable cash flow than you are doing. Consequently, this could cause significant troubles with your case.

West Virginia's exemption amounts are altered periodically and therefore are not staying updated on this page. You'll want to use The latest figures. Evaluation statutes from the West Virginia Code or talk to an area bankruptcy lawyer. LegalConsumer.com also consistently updates state exemptions.

Kristen, California "I really favored that a copy automatically got filed While using the court for me."

Testimonials will be the persons' expressed view and will not be reflective of all ordeals with the you can try here company.

Our cost-free Device has aided fourteen,019+ people file bankruptcy by themselves. We see here are funded by Harvard College and will never talk to you for a credit card or payment.

If both you and your partner are filing a joint bankruptcy, you have to incorporate their cash flow and fees on most of the necessary bankruptcy forms.

This “discharged in any case” cure usually incorporates run-of-the-mill common debts like a normal health care Invoice original site or unsecured credit card similar to a Visa, MasterCard or Uncover, which can be thought of unsecured debt.

Looking to boost your financial effectively-being and consolidate your financial debt? As well as evaluating the highest personal debt consolidation lenders, we have compiled some of the most commonly questioned questions about debt consolidation.

Bankruptcy exists that will help people today get again on their own feet and regain Charge of their funds. To help you with this, the government created a set of exemptions that allow individuals to maintain their Standard of living even though resolving their difficulties with creditors.

In check these guys out bankruptcy, debts are called “claims”. All feasible “statements” ought to be listed, Even when you dispute the credit card debt or claim, or don’t think you have to be held responsible for the debt or assert. Some debts are so outdated that they're beyond the statute of limitations to file a lawsuit to gather the credit card debt, but these remain considered “claims” beneath the definition of “promises” in bankruptcy regulation.

Having said that, you have to get current in your home loan payments when you file your bankruptcy scenario. explanation If not, the lender normally takes your property back again, no matter the exemption.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Michelle Trachtenberg Then & Now!

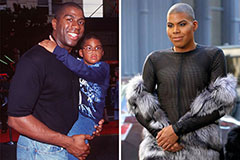

Michelle Trachtenberg Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!